A little over ten years ago, the idea of having a form of digital cash was laughable. Up until the birth of bitcoin, early versions of digital money were plagued by the double-spend problem. Without some kind of middleman, it was hard to be able to trust and verify transactions — much in the same way that if someone emails you a photo you have no idea how many copies of that photo exist, or who else has one.

Without solving for double-spend, money would forever be stuck in the analog world. Sure, things like direct deposit and paying bills over the internet were possible. But that’s not really digital money. That’s just digital functionality added to old money. In the end, you would still need a bank, or a credit card company, or a payment service provider to vouch for the legitimacy of the transaction. Having layers of middlemen costs time and money. There are also other tangibles involved with the middleman model related to privacy, censorship, and trust.

And then bitcoin came along. It was first proposed in late 2008 to a popular cypherpunk email list by the mysterious Satoshi Nakamoto (we still have no idea about the true identity of the person behind bitcoin) as a way to conduct peer-to-peer cash-like transactions. Building on decades of work in public key cryptography, Nakamoto claimed to have solved the double-spend problem.

In early 2009, bitcoin launched and early adopters started using the network. At the time, one bitcoin was worth pennies. Early bitcoin adopters existed at the fringes: free-staters, gamblers, etc.

Bitcoin has never been run by a company and it is not under the control of any kind of official company. Instead, it exists as an open-source network that anyone can join, run, and improve. These attributes kept driving the growth and adoption of bitcoin for people looking for alternatives to traditional finance, and for a better way to store, send, and share value.

In the ten years since bitcoin’s launch, it has gone from a novelty pitched on a niche forum in the remote corner of the internet, to the anchor of a new global financial movement. Along the way, the idea of bitcoin — of digitally-native money that can exist without needing a trusted (and costly) middleman — matured into an entirely new sector based on the principles of decentralization and global accessibility.

What’s become apparent in the last ten years is that bitcoin solved a larger problem than the vexing double-spend issue. By combining the power of computer code with the basic rules governing currency (portable, divisible, fungible, etc.), bitcoin can be made into programmable money, which can be used for tomorrow’s sophisticated applications. Put another way, software is eating money.

The full value of bitcoin and other cryptocurrencies is yet to be realized or even fully understood for that matter. By now, there are more than 2,000 different kinds of cryptocurrencies, hundreds of companies supporting the new decentralized economy, and an addressable market of seven billion people and growing daily. At the most recent high water mark at the end of 2017, bitcoin reached the price of $20,000, while the entire crypto market hit $795 billion in early January of 2018.

Future forecasts of the crypto market cap reaching many multiples of where it is today sometimes feel like over-exuberant speculation. But looking at the data from the past decade, and overlapping some basic market fundamentals, paints a different picture of unprecedented opportunity.

Investing in cryptocurrencies

While cryptocurrencies are still volatile in terms of market movements (the price of all cryptos have retracted massively from the all-time highs in 2018 in what insiders call crypto winter), the growth in value of the entire industry is happening at a pace unrivaled by anything else in history. As bitcoin and other cryptocurrencies continue to mature, there are several high-level, long-term investment ideas developing.

One of the biggest ways that cryptocurrencies get their value is by the size of the network they can create. In the case of bitcoin, the network is designed to gain strength and value as it expands and becomes more distributed. Game theory and other tactics are baked into the underlying protocol to help it become more resilient and robust as time goes on. The networks also have their own economies that grow with use. Tokens or coins are created for services such as maintaining and verifying the network, and users pay transaction fees in native tokens, which essentially creates a flywheel effect as the networks grow, the coins become more valuable, which encourages more adoption.

In the digital age, the size and integrity of a network are the basis for unicorn-level valuations. In some ways, cryptocurrencies are growing like the early internet, only this time people can invest in the underlying protocol or infrastructure and not just the applications being built on top of those protocols.

Another major investment thesis for bitcoin is that it is a digital store of value. In many parts of the world, having a place to keep assets outside of the control of a government or centralized financial institutions is a major breakthrough and extremely valuable. In more stable economies, having a portable and extremely liquid place to store assets and wealth also has its advantages. Before bitcoin, there was no secure store of-value digital asset. It should be noted that gold has a market capitalization of about $8 trillion and exists largely as a store of value with no significant use for commerce. So even if cryptocurrencies like bitcoin were able to capture part of the market share, the potential crypto market valuations have very significant room to grow.

WHAT IS ABRA?

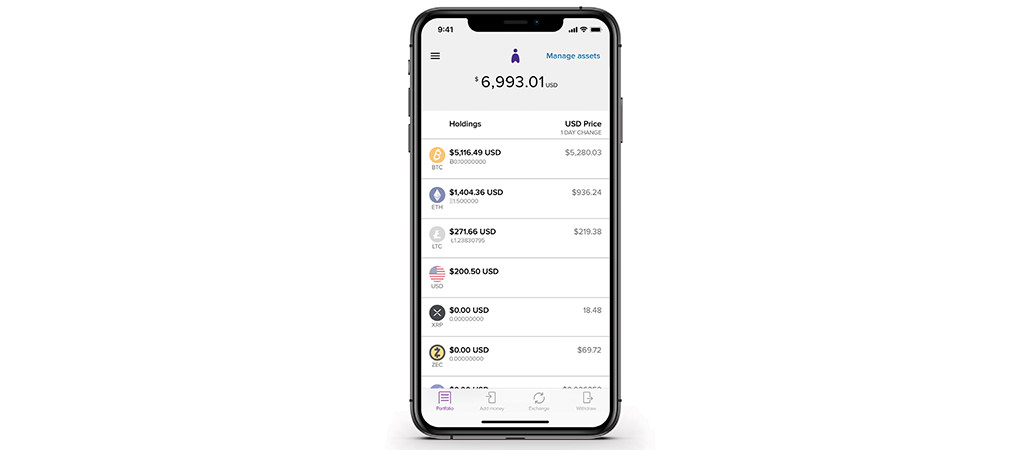

Abra is the world’s first global investment app. Unlike other investment apps, cryptocurrency exchanges or wallets, Abra’s non-custodial model is backed by the Bitcoin blockchain using smart-contract technology, which means it’s secure, private, and gives users full control of their money. The company empowers consumers to invest in 30 crypto assets, and soon US stocks and ETFs across the world, all within a single, easy-to-use app. Abra users can also quickly exchange multiple crypto or fiat currencies and instantly transfer currencies to other Abra users. Founded in 2014 and headquartered in San Francisco, Abra is available in over 155 countries. For more information, visit https://www.abra.com/

BITCOIN: Bitcoin is both a network and a cryptocurrency. The network is open source and globally distributed, and acts like a public ledger that registers transactions. The currency is created through a process of computation and is designed to reward the confirmation of transactions and maintenance of the network. Launched in 2009, Bitcoin is the first massively adopted cryptocurrency.

ALTCOIN: An altcoin is any cryptocurrency other than Bitcoin. In the early days of cryptocurrencies, there were only a handful of altcoins. Today there are more than 2,000 altcoins that serve different functions.

BLOCKCHAIN: A blockchain is the data structure that makes public, permission-less cryptocurrencies like Bitcoin work. A blockchain consists of groups of confirmed transactions (blocks) that are linked (chain) forming a record that would be costly in terms of computation and energy resources to go back and undo. Blockchains allow people to interact and share data (or in the case of Bitcoin, share value) without the need for a centralized data gatekeeper such as a corporation or government.

CRYPTOCURRENCY: Cryptocurrencies, crypto assets, or just crypto most often refers to a system of creating and accounting for value on a blockchain using public key cryptography. Public key cryptography means that users hold a private key, which is used to access the assets stored on a blockchain, while a public key exists so that certain transaction details are publicly auditable.

MINING: A process of using complex computation to maintain a public blockchain in a proof-of-work network.

WALLET: A cryptocurrency wallet contains the details necessary to access blockchain-based assets. Wallets contain a public key and a private key. Private keys need to be secured and properly stored. A public key can be shared and can act like an email address for sending and receiving funds from others.

Bitcoin and other cryptocurrencies are also being used as a form of digital collateral as more traditional or physical assets become “tokenized” or digitized. Some companies are doing this with real estate. The global investment app, Abra, for example, enables users across the world to get access to top US stocks and ETFs like Apple, Tesla, S&P500, etc. all using bitcoin as collateral.

Such a use case was never possible before bitcoin. Crypto-collateralization opens up access and investment potential to a range of assets by making things like micro and fractional investing possible. Considering that the US stock market alone contains an estimated $34 trillion in value and the value of the global real estate market is $8.5 trillion (2017) — if small fractions of those markets became collateralized by bitcoin or cryptocurrencies, that would represent orders-of-magnitude crypto market growth.

There are a number of other key potential uses for bitcoin and other cryptocurrencies that are fueling today’s valuations. People are building everything from a decentralized, a-political reserve currency of the future to platforms capable of instantaneously brokering complex business transactions with multiple inputs via smart contract functionality. Crypto is being used for the backend of what people are calling Web 3.0, which, if the Web 2.0 movement is any indication, will generate new products, services, and create value for entrepreneurs and investors.

Role of cryptocurrency in a traditional portfolio

So, this might be a good time to temper all future science-fiction-sounding investment speculation with some real-world analysis of how crypto can fit into a traditional investment portfolio that is made up of stocks and bonds. One interesting takeaway is that even small allocations of crypto to a traditional investment portfolio can have noticeable impacts.

One way of evaluating how crypto performs in the context of a traditional investment portfolio is to look at how it performs at the asset class level. (For the analysis that follows, bitcoin was used as a proxy for the crypto sector more broadly).

The most popular traditional asset classes for investors have been stocks (equities), bonds (fixed income), commodities (such as gold and other metals and oil), and real estate. All of the asset classes are attractive to investors because they behave differently during times of economic growth and contraction.

Using the characteristics of these assets, investors optimize portfolios for upside, but also for risk, which requires diversifying across a number of assets to make sure the portfolio is slightly insulated from major economic movements. Modern portfolio theory provides a handful of benchmarks for making decisions about how to compose holdings consisting of diversified investments. Two of the major concepts, as they apply to crypto as a new investment class, are correlation and the Sharpe Ratio.

Correlation looks at how different asset classes compare in comparison to one another. Ideally, a portfolio consists of low-correlation assets, so that major market movements in one sector are covered by another.

The development of cryptocurrencies as an independent asset class gives investors another option for hedging their portfolios with uncorrelated assets. Diversifying across different and uncorrelated asset classes can not only have an impact on overall portfolio returns, but it can also serve to reduce overall exposure risk.

Another aspect of the cryptocurrency asset class is that for the last six of the past nine years, crypto has had a higher Sharpe Ratio when compared to traditional asset classes. The Sharpe Ratio is a measure of risk-adjusted return. Since crypto has traditionally been a volatile asset, investors need a way to understand the net effect of that volatility. So, using tools like the Sharpe Ratio show that despite its volatility, crypto still has positive returns when compared to risk most of the time. Assets with a higher Sharpe Ratio are beneficial to overall portfolio health because they indicate the opportunities that might lead to higher upside.

The properties that make crypto somewhat of an outlier in terms of an asset class are the same reasons why it is also a great addition to a traditional portfolio. Even the addition of small percentages help impact the overall risk/reward profile and returns.

The future will be decentralized

Cryptocurrencies are often over-hyped or else poorly understood. But somewhere in the middle of those two extremes exists a unique financial and technological opportunity. Cryptocurrencies represent a shift in the foundation of finance. A simple analogy is that cryptocurrencies will do for money what the internet did for information.

Eventually, cryptocurrencies could become the basic financial infrastructure of the future, playing a role as the transport and settlement layer for everything from payment and credit to loans and investments. The greatest news is that despite the enormous growth across all facets of the emerging crypto sector, it is still very early in terms of investor opportunity.